|

|

C. Translate into Russian ⇐ ПредыдущаяСтр 2 из 2

1) The managing director prefers to leave financial affairs to his accountant. 2) Last year’s financial results show that it was a very profitable one for the Group. 3) I’ve just received this letter of acceptance so we can go ahead. 4) Her financial adviser is convinced the project will be a success. 5) Any line which proved unprofitable was immediately discontinued. 6) Before we can decide about developing new products, we need to know how profitable the existing product are. 7) Many accounting departments have strict entrance requirements. 8) The financial condition of a company is reflected in its financial statements. 9) Payroll is the amount of money to be payed to a list of employees.

D. Find the proper definitions

E. Choose the best alternatives to complete the sentence

1) It’s up to the accountant to … the various financial statements. a) interpret b) intercept c) invent d) translate 2. The bookkeeper keeps a record of every financial …. a) action b) transaction c) entry d) tell 3. Transactions between the firm and its markets are defined as …. a) internal transaction b) financial transaction c) credit transaction d) external transaction 4. The totality of “internal transaction” forms the subject matter of …. a) financial accounting b) administrative accounting c) fund accounting d) national accounting 5. Transactions within the firm are defined as …. a) internal transactions b)) internal transactions c) accounting transactions d) bookkeeping transactions 6. The totally of “internal transactions” forms the subject matter of …. a) financial accounting b) primary accounting c) cost accounting d) retirement accounting 7. The purpose of cost accounting is to generate information for making sound … a) pricing decisions b) make-or-buy decisions c) executive decisions d) internal decisions

G. Answer the following questions

1) What does the study of accounting begin with? 2) In what way may the activity of an organization be presented? 3) What is business activity associated with in accounting? 4) When does a transaction occur? 5) What business activities are recognized in accounting? 6) How can transactions be classified? 7) What is financial accounting? 8) What is managerial accounting?

H. Sum the text in 7-10 sentences and present your summary in class

7.3. Additional texts

THE ACCOUNTING PROFESION

Accounting is an old profession. Records of business transactions have been prepared for centuries. However, only during the last half-century accounting has been accepted as a profession with the same importance as the medical or legal profession. Positions in the field of accounting may be divided into several areas. Two general classifications are public accounting and private accounting. Public accountants are those who serve the general public and collect professional fees for their work, much as doctors and lawyers do. Their work includes auditing, income tax planning and preparation, and management consulting. Public accountants are a small fraction (about 10 percent) of all accountants. Private accountants work for a single business, such as a local department store, the McDonald’s restaurant chain, or the Eastman Kodak Company. Charitable organizations, educational institutions, and government agencies also employ private accountants. The chief accounting officer usually has the title of controller, treasurer, or chief financial officer. Whatever the title, this person usually carries the status of vice-president. In contrast to public accountants who provide accounting services for many clients, management accountants provide accounting services for many clients, management accountants provide accounting services for a single business. In a company with many management accountants, the executive officer in charge of the accounting activity is often called a controller.

USERS OF ACCOUNTING INFORMATION

The text discuses the range of people and groups who use accounting information. Individuals. People use accounting information in day-to-day affairs to manage their bank accounts, to evaluate job prospects, to make investments, and to decide whether to rent or to buy a house. Businesses. Managers of business use accounting information to set goals for their organizations, to evaluate their progress toward those goals, and to take corrective action if necessary. Decisions based on accounting information may include which building and equipment to purchase, how much merchandise inventory to keep on hand, and how much cash to borrow. Investors and Creditors. Investors provide the money that businesses need to begin operations. To decide whether to help start a new venture, potential investors evaluate what income they can reasonably expect on their investment. This means analyzing the financial statements of the new business. Those people who do invest monitor the progress of the business by analyzing the company’s financial statements and by keeping up with developments in the business press. Before making a loan, potential lenders determine the borrower’s ability to meet scheduled payments. This evaluation includes a projection of future operations, which is based on accounting information. Government Regulatory Agencies. Most organizations face government regulation. Government regulation agencies base their regulatory activity in part on the accounting information they receive from firms. Taxing Authorities. Local, state, and federal governments levy taxes on individuals and businesses. The amount of the tax is figured using accounting information. Businesses determine their sales tax based on their accounting records that show how much they have sold. Individuals and businesses compute their income tax based on how much money their records show they have earned. Non-profit Organizations. Non-profit organizations – such as churches, most hospitals, government agencies, and colleges, which operate for purposes other than to earn a profit – use accounting information in much the same way that profit-oriented business do. Both profit and non-profit organizations deal with budgets, payrolls, rent payments, and the like – all from the accounting system. Other users. Employees and labour unions may make wage demands based on the accounting information that shows their employer’s reported income. Consumer groups and the general public are also interested in the amount of income that businesses earn.

LESSON 8

8.1. Basic text. Read and translate the text using the following words and word combinations

· economic entity – экономическая единица · an assigned task – поставленная задача · tax return – налоговая декларация · vendor’s invoice – счёт-фактура продавца · considering – принимая во внимание · quantifiable – количественно определяемый

AUDITING

Auditing is the process by which a competent, independent person accumulates and evaluates evidence about qualifiable information related to a specific economic entity for the purpose of determining and reporting on the degree of correspondence between the quantifiable information and established criteria. This definition includes several key words and phrases. Qualifiable information and established criteria. To do an audit, there must be information in a verifiable form and some standards (criteria) by which the auditor can evaluate the information. Qualifiable information can and does take many forms. It is possible to audit such things as a company’s financial statements, the amount of time it takes an employee to complete an assigned task, the detail cost of a contract, and individual tax return. The criteria for evaluating qualifiable information can also vary considerably. For example, in auditing a vendor’s invoice for the acquisition of raw materials, it is possible to determine whether materials of the quantity and stated description were actually received, whether the proper raw material was delivered considering the production needs of the company, or whether the price charged for the goods was reasonable. Economic entity is a legal entity, such as a corporation, unit of government, partnership, etc. Whenever an audit is conducted, the scope of the auditor’s responsibilities must be made clear. The primary method involves defining the economic entity and the time period, the last typically being one year, but may be for a month, a quarter, several years, and even the life time of entity. Accumulating and evaluating evidence. Evidence is defined as any information used by the auditor to determine whether the quantifiable information being audited is stated in accordance with the established criteria. Evidence takes many different forms, including oral testimony of the auditee (client), written communication with outsiders, and observations by the auditor. It is important to obtain a sufficient quality and volume of evidence to satisfy the audit objectives. Competent, independent person. The auditor must be qualified to understand the criteria used and competent to know the types and amount of evidence to accumulate to reach the proper conclusion after the evidence has been examined. The auditor must also have an independent mental attitude. Independence cannot be absolute by any means, but it must be a goal that is worked toward and it can be achieved to a certain degree. Even through an auditor is paid by a company, he or she may still be sufficiently independent to conduct audits that can be required and can be relied upon by users. Reporting is the communication of the findings to users. The final stage in the audit process is the audit report. Reports differ in nature, but in all cases they must inform readers of the degree of correspondence between qualifiable information and established criteria. Reports also differ in form and can vary from the highly technical type usually associated with financial statements to a simple oral report in the case of an audit conducted for a particular individual.

Your vocabulary auditing – проведение ревизии to audit – проверять, проводить ревизию to evaluate – оценить to include – включать to determine – определять raw materials – сырьё to deliver – поставлять to charge a price – назначить цену to involve – включать to define – определять sufficient quality – достаточно высокое качество to satisfy – удовлетворять a goal – цель to achieve – достигать to conduct audit – проводить ревизию to vary – изменяться financial statement – финансовый отчёт

8.2. Exercises

A. Make the following words negative

B. Work with synonyms. Differentiate between

1) buy – purchase 2) expenses – expenditures – costs 3) income – revenue 4) profit – return 5) rent – hire – lease

C. Translate. Ray attention to the economic and business terms

1) Audit is the inspection of an organization’s annual accounts. 2) Bad debts are potential losses of the company that may never be paid. 3) Business activities are limited by transactions. 4) Inputs are resources used in production process such as labour, raw or semifinished materials. 5) Output are transformed materials; the results of production. 6) The general public is interested in the amount of income that business ears. 7) Financial statements are formal reports providing information about a business financial position

D. Find the proper definitions for the following

E. Answer the following questions

1) What is auditing? 2) What is it possible to audit? 3) How can you define economic entity? 4) How is evidence defined? 5) What is it important to obtain to satisfy the audit objectives? 6) What must the auditor be qualified to? 7) What is reporting? 8) How do the reports differ?

F. Speak about auditing

8.3. Additional texts

TYPES OF AUDIT

Three types of audit are the main ones: operational audits, compliance audits, and audits of financial statements. Operational audits is a review of any part of an organization’s operating procedure and methods for the purpose of evaluating efficiency and effectiveness. At the completion of an operational audit, recommendations to management for improving operations are normally expected. In operational auditing, the reviews are not limited to accounting. They can include the evaluation of organization structure, computer operation, production methods, marketing, and any other area in which the auditor is qualified. In this sense, operational auditing is more similar to management consulting than to what is generally required as auditing. Compliance audits. The purpose of the compliance audits is to determine whether the audit is following specific procedures or rules set down by some higher authority. A compliance auditing could include determining whether accounting personnel are following prescribed procedures, reviewing wage rates for compliance with minimum laws, or examining contractual agreements with bankers and other lenders, etc. Audits of financial statements. This type of auditing is conducted to determine whether the overall financial statements are stated in accordance with specific criteria. The assumption underlying an audit of financial statements is that they will be used by different groups for different purposes. Normally, the criteria are generally accepted accounting principles.

BOOKKEEPING

Bookkeeping is writing down all the transactions arising from business activities which can be expressed in money. To run your business well you must know what money you have received, how much money you have spent and, most important of all, how you spent it. A bookkeeping system can provide you with that information. The books used for keeping records consist of a ledger and subsidiary books. The ledger is the general book in which you enter almost all the figures arising from your business activities. A ledger consists of a number of accounts. A chart of accounts serves as an index to the ledger, and each account is numbered to facilitate the frequent references that are made to it. An account is a column in the ledger that has been given a specific name, e.g. Cash, Bank, Sales and etc. The invoice book helps you to remember who owes the business money for goods and services you have sold but have not been paid for. When you have delivered a commodity or provided a service you send an invoice to the customer. You keep a copy of the invoice in the invoice book. The purchase journal is used to write down details of goods and services bought on credit which are not yet paid for. The invoice you receive from the supplier is kept in the purchase journal until it is fully paid The wages book. In this book you make notes about your employee names, wages, advance payments and so on.

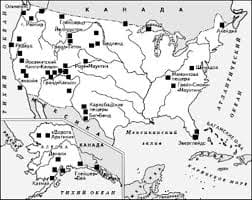

ЧТО ПРОИСХОДИТ, КОГДА МЫ ССОРИМСЯ Не понимая различий, существующих между мужчинами и женщинами, очень легко довести дело до ссоры...  Что будет с Землей, если ось ее сместится на 6666 км? Что будет с Землей? - задался я вопросом...  Система охраняемых территорий в США Изучение особо охраняемых природных территорий(ООПТ) США представляет особый интерес по многим причинам...  Что способствует осуществлению желаний? Стопроцентная, непоколебимая уверенность в своем... Не нашли то, что искали? Воспользуйтесь поиском гугл на сайте:

|