|

|

Extra customer care 24 hours a day, 365 days a year.FREE 24 hour helpline mid emergency repair service. Should you unfortunately suffer an emergency like a burst pipe or tiles blown off your roof, simply call our FREEPHONE 24 hour emergency number, any day of the year. We will provide practical help from a competent local tradesman and we will pick up the bill up to 150 for each call out necessary. VOCABULARY: property insurance - страхование имущества building and contents insurance - страхование зданий и находящегося в них имущества quotation - котировка, страховой тариф premium assessment - расчет страховой премии to cover - зд. покрывать, входить в страховое покрытие «new for old» - «новое вместо старого» insurance cover - страховое покрытие wear and tear - физический и моральный износ claim settlement - урегулирование претензии

VOCABULARY CHECK 1) Страховая компания сделает все возможное, чтобы клиент точно знал, что входит в страховое покрытие, если он застрахует свое имущество у них. 2) Вы можете получить страховой полис (заключить договор страхования) в Royal Insurance, если Вы ответите «да» на шесть вопросов в анкете. 3) Если Вы вышлете купон или позвоните в нашу страховую компанию, мы бесплатно пришлем Вам наши тарифные ставки. 4) Royal Insurance обеспечивает покрытие «новое вместо старого» в случае, когда Вы предъявляете претензию в отношении утерянных или поврежденных предметов. 5) Некоторые страховые компании выплачивают лишь первоначальную стоимость имущества. 6) Компании, занимающиеся страхованием личного имущества, разработали систему оценки страховой премии.

SECTION 2 UNDERLYING PRINCIPLES LEAD-IN It is sometimes said that insurance is like gambling. In betting, for example, one gives a sum of money to a bookmaker who agrees to pay out on the bet if the horse one has backed wins the race. The law however has found a means of distinguishing between gambling contracts, which it will not enforce, and insurance contracts, which it will. For a contract to be one of insurance the insured person must have an insurable interest in the subject matter of the insurance. That is, he must stand to lose financially if the event insured against happens. In life insurance, for example, a man or woman obviously has an interest in his or her own life and can therefore insure it and also the life of a husband or wife. But one cannot insure the life of anybody else unless their death would result in financial loss to oneself. Similarly, with property, insurance may only be effected if one stands to lose financially by its loss or destruction. Clearly the owner of the property would lose but so also might other people, such as a building society which has lent money on the security of a house or dry cleaner who has taken in clothes for cleaning. Further, in insurances on property or against liabilities the law applies the principle that the policyholder must not make a profit if the event insured against happens. The insurance contract is said to be one of indemnity, to make good the insured's loss and no more. Suppose, for example, that property is insured for more than its value and is destroyed as a result of an event insured against. The insured's recovery will be limited to the actual value. Again, if the property has been insured twice over and is destroyed, the insured will not be entitled to recover in all more than its total value. And if insured property is destroyed in circumstances which give the insured a right to claim both against his own insurer and against some other person who was responsible for the damage, the insured must allow the insurer to have the benefit of the right to claim against the other person. Contracts of insurance form a special class of contract in that the law requires both parties to them, the insured and the insurer, to exercise the utmost good faith towards each other. In particular when anyone applies for insurance (he is known as the proposer) he must tell the prospective insurer every fact that he knows or ought to know which would influence a prudent insurer in deciding whether to grant the insurance and, if so, on what terms. To take an example, a proposer for life insurance must reveal if he has recently had a heart attack as this may be a sign that he is more likely to die prematurely. Similarly if a motorist is seeking to insure his car and has had a number of recent road accidents he must reveal that fact so that the insurer can decide whether to charge him an above-normal premium because he appears to be especially prone to accidents. If any fact of the kind described is not disclosed by the proposer or if any fact is misstated, even unintentionally, the insurer is entitled to refuse to pay a claim under the policy. Insurers maintain that this is only right because the proposer knows the facts and the insurer does not. The insurer needs to be put in a fair position to decide whether to accept an insurance and on what terms. Insurance companies have to invest the money they receive from premiums. Like pension funds, they are large institutional investors that invest huge sums in securities, especially low-risk ones like government bonds. The largest insurance market in the world is Lloyd’s of London. This is an association of people called underwriters, who guarantee to indemnify other people’s possible losses. Lloyd’s spreads risks among a number of syndicates: groups of wealthy individuals, commonly known as ‘ names ’. These people can earn a lot of money from insurance premiums if the clients never claim for compensation, but they also have unlimited liability or responsibility for losses. If insurance companies consider that they have underwritten too many risks, they can sell some of that risk to a reinsurance company. This is a company that will receive some of the premium and also bear, or take, some of the risk.

VOCABULARY

COMPREHENSION QUESTIONS: 1) Why is insurance sometimes compared with gambling? 2) What is the difference between gambling contracts and insurance contracts? 3) What is an insurable interest? 4) What does the expression “to exercise the utmost good faith towards each other” mean? 5) When is the insurer entitled to refuse to pay a claim under the policy? VOCABULARY PRACTICE For a contract to be one of insurance the insured person must have an insurable interest in the subject matter of the insurance. The insurance contract is said to be one of indemnity, to make good the insured's loss and no more. According to the insurance contract the insured and the insurer must exercise the utmost good faith towards each other. A proposer for life insurance must reveal if he has recently had a heart attack. The insurer needs to be put in a fair position to decide whether to accept an insurance and on what terms.

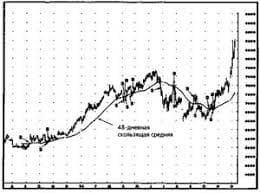

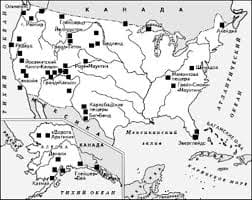

TEXT TO TRANSLATE: Insuring for the future?   Что вызывает тренды на фондовых и товарных рынках Объяснение теории грузового поезда Первые 17 лет моих рыночных исследований сводились к попыткам вычислить, когда этот...  Что способствует осуществлению желаний? Стопроцентная, непоколебимая уверенность в своем...  Что будет с Землей, если ось ее сместится на 6666 км? Что будет с Землей? - задался я вопросом...  Система охраняемых территорий в США Изучение особо охраняемых природных территорий(ООПТ) США представляет особый интерес по многим причинам... Не нашли то, что искали? Воспользуйтесь поиском гугл на сайте:

|