|

|

The concept of market equilibrium and equilibrium prices. The pricing mechanism in the market economy.

The point where the demand curve and the supply curve cross each other at the demand-and-supply diagram is the equilibrium point. Market equilibrium is the characteristic of market conditions - commodities quantities and prices, when quantity demanded is equal to quantity supplied. They are reflected in information provided by market - commodities prices. Economic agents - both sellers and buyers - use this information for decision making about their behavior. If initial market conditions are equilibrium conditions, they would not be changed (would be the same) at the next step, ceteris paribus. As a result, the equilibrium situation can be characterized as a realization of all decisions made. The value PE is called equilibrium price, if the quantity of commodity demanded under this price is equal to the quantity of commodity supplied. As figure 3.1 shows, the equilibrium point exists and it is unique for demand-and-supply diagram. The demand curve DD and the supply curve SS at the figure 1 cross each other at point E with coordinates (QE, PE). Law of uniform (one) price: A homogeneous good trades at the same price no matter who buys it or which firm sells it. When a market price P deviates from equilibrium price PE (or a quantity of a good Q deviates from equilibrium quantity QE) an excessive supply or excessive demand is formed at a market. Shortage (or an excess demand): The difference between quantity demanded and quantity supplied in a market when quantity demanded is greater than quantity supplied (Fig. 3.2, P2<PE). Surplus (or an excess supply): The difference between quantity supplied and quantity demanded in a market when quantity supplied is greater than quantity demanded (Fig.3.2, P1>PE).

Changes in demand and supply in the market generate changes in equilibrium situation. a) An increase in market demand (represented by an outward shift in the demand curve D 0 D 0) increases both the equilibrium price PE and equilibrium quantity QE. (Fig.3.3a) b) If market demand falls (this is represented by inward shift in the demand curve D 0 D 0), both equilibrium price and equilibrium quantity fall. (Fig.3.3b) c) If the market demand rises (the demand curve S0S0 moves outward), the equilibrium price falls and the equilibrium quantity rises. (Fig.3.3c) d) Decrease in market supply (represented by inward shift in the supply curve) moves the equilibrium price up and equilibrium quantity down. (Fig.3.3d) e) The simultaneous changes in demand and supply can move equilibrium price and quantity in various directions, as figures above show.

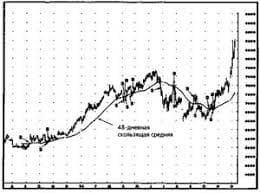

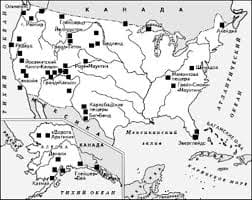

3. Organizational and legal forms of entrepreneurship. The classification of firms and their role in the economy. Key words commercial enterprise – коммерческое предприятие sole proprietorship – индивидуальное предпринимательство raise money – добывать денежные средства (инвестиции) settle the debts – улаживать долги hire, employ – нанимать employer – работодатель employee – сотрудник, работник dissolve – ликвидировать retire – уходить в отставку, на пенсию bear the responsibility – нести ответственность retailing – розничная торговля maintenance – тех.обслуживание partnership – товарищество accountancy – бухгалтерия real estate – недвижимость corporation, joint-stock company – корпорация, акционерное общество fraction – доля go bankrupt – обанкротиться Stock Exchange – фондовая биржа salary – оклад, зарплата CEO (chief executive officer) – топ-менеджер double taxation – двойное налогообложение mismanagement – неэффективное руководство state-owned corporation – государственное предприятие appoint – назначать (на должность) privatize and nationalize – приватизировать и национализировать private limited companies – закрытое акционерное общество public limited company – открытое акционерное общество forward or backward integration – интеграция «вверх» или «вниз» horizontal or vertical integration – горизонтальная или вертикальная интеграция expansion – расширение, укрупнение, рост merger – слияние takeover – поглощение acquisition – выкуп, приобретение limited liability – ограниченная ответственность shareholder (BE), stockholder (AE) – акционер bankruptcy – банкротство property – собственность profit – прибыль shares (of stock) – акции 1. Terms of business development. Kinds of entrepreneurship. Business is a commercial enterprise performing all those functions that govern the production, distribution, and sale of goods and services for the benefit of the buyer and the profit of the seller. The existing forms of business organization enable various branches of industry to adapt to changing conditions and to function more efficiently and profitably. The main three forms of business ownership are sole proprietorship, a partnership, and a corporation. Sole proprietorship is ownership of a business by a singleperson. The sole proprietor provides capital to run the business and makes all the decisions. He/she employs other people and is responsible for the success and for the failure of the business. It is the simplest and the oldest form of business ownership. Advantages: · It is relatively easy to start this type of business; · The owner has an incentive to run the firm efficiently as all the profits are his/hers; · It is a flexible type of business as the owner can quickly respond to changes in the market conditions. Disadvantages: · Unlimited liability – in case of bankruptcy the owner may lose all his property including his personal assets including a house/flat, a car, etc. that can be sold to settle the debts of the business; · A single owner is seldom able to invest as much capital as a partnership or a corporation can obtain; · Unless the owner has much personal wealth, the business may have difficulty borrowing money in critical times; · A sole proprietor may also have difficulty hiring and keeping good employees because the business will dissolve when the owner retires or dies. · The owner faces all the risks, and alone bears all the responsibility for the business. In many countries this type prevails in such sectors as farming, retailing, repair and maintenance work, personal services (e.g. hairdressing).But in terms of total employment, capital and output this type is relatively unimportant. A partnership is an association of two or more persons who have agreed to combine their financial assets, labor, property, and other resources as well as their abilities and who carry on a business jointly for the purpose of profit. The agreement the partners usually sign to form an association is known as a partnership contract and may include general policies, distribution of profits, responsibilities, etc. Advantages are similar to those of sole proprietorship: it iseasy to establish a partnership, and this is also a flexible form of business. It is usually easier for partnerships to obtain additional financing because the personal assets of the group are usually larger and the chances of success are higher. Disadvantages: · Unlimited liability of each partner for the debts of the business, i.e. complete financial responsibility for losses. · Partners who wish to retire may find it difficult to recover their investments without dissolving the partnership and ending the business. · Partnerships dominate in such professions as law, accountancy, medical services, real estate business and so on. · A business corporation (AE) is an organization created by law that allows people to associate together for the purpose of profit making. Corporations are also known as joint-stock companies (BE) because they are jointly owned by different persons who receive shares of stock in exchange for an investment of money in the company. Shares represent fractions of the company’s assets such as cash, equipment, real estate, manufactured goods, etc. · Though the corporation is more difficult and expensive to organise than other business forms, it has a number of advantages. Most business people form limited companies. In this case shareholders have the liability only for the amount of money they have invested. If the company goes bankrupt, their personal possessions are not in danger, i.e. they cannot be sold to pay the debts of the company (except in criminal cases). · Most companies begin as private limited companies as the founders invest their private capital (or borrow from banks). Successful, growing companies apply to one of the Stock Exchanges to become a public limited company. After that its shares are traded in different financial markets and anyone can buy shares at the market price. Advantages: • Limited liability – if the corporation goes bankrupt, shareholders can lose no more than they have invested. • Money to operate the business is obtained by the sale of stocks to the general public and this enables the corporation to exist independently of its owners. • The corporation finds it easier to borrow money from banks and it is also a successful means for attracting large amounts of capital and investing the latter in plants, modern equipment and expensive research. • Salaries large corporations can offer to managers and specialists are high, and that allows corporations to hire professional and talented CEOs and employees. Disadvantages: • A double taxation of profits: taxes are first paid on net income, and then shareholders pay taxes on their dividends; • Numerous financial reports must be sent to various federal regulatory agencies; • In large corporations shareholders have no real control over the business and as a consequence there is risk of mismanagement that may lead to bankruptcy. A state-owned corporation has no private shareholders. Government owns the business and appoints managers to run it. Profits are used for investments. If this type of business is inefficient, government may sell it, i.e. have it privatized (as it happened with some large state-owned companies in the UK in the 1980s). The purpose of this type is to run an industry which is important for the national economy. For example, such large nationalized industries in the UK as the Port of London (1909), and the BBC (1927). Another purpose of state-owned corporations is to provide important public services at a reasonable price. For example, the Tennessee Valley Authority in the USA is a federal corporation providing power and irrigation services, and flood control since the 1930s. Public interest requires organization and operation of business to be subject to governmental regulation. Government regulation, particularly in the USA, attempts to prevent the formation of monopolies that totally control a particular branch of industry such as steel, petroleum, or automobile production.   Конфликты в семейной жизни. Как это изменить? Редкий брак и взаимоотношения существуют без конфликтов и напряженности. Через это проходят все...  Что вызывает тренды на фондовых и товарных рынках Объяснение теории грузового поезда Первые 17 лет моих рыночных исследований сводились к попыткам вычислить, когда этот...  ЧТО ПРОИСХОДИТ ВО ВЗРОСЛОЙ ЖИЗНИ? Если вы все еще «неправильно» связаны с матерью, вы избегаете отделения и независимого взрослого существования...  Система охраняемых территорий в США Изучение особо охраняемых природных территорий(ООПТ) США представляет особый интерес по многим причинам... Не нашли то, что искали? Воспользуйтесь поиском гугл на сайте:

|