|

|

Economy minister hopes for IMF agreement within 10 daysKemal Derviş, Turkey's new economy minister, yesterday outlined key structural reforms in a radical rescue package intended to haul the economy out of crisis. The former World Bank economist also said additional financial assistance from the international community was necessary to help bring down "sky-high interest rates" that he identified as the main threat to Turkey's fragile financial system. Mr Derviş was appointed two weeks ago to salvage ambitious economic reforms following the collapse of an earlier programme that was backed by the International Monetary Fund. Turkey was forced to abandon a pegged exchange rate and allow a 25 per cent devaluation of the Turkish lira after financial turmoil triggered by a political dispute between the president and prime minister. Mr Derviş said he hoped a complete revised reform plan -including a new inflation target and other macroeconomic indicators - could be agreed with the IMF within 10 days. Mr Derviş conceded that the IMF was unlikely to increase the overall amount of money -$11.4bn - that has already been pledged to Turkey, though he expected greater flexibility in the way a remaining $7bn still outstanding could be spent. He said Ankara was looking for increased "bilateral assistance" from individual countries, as well as "the support of the markets and both domestic and international banks". A key element of the package -which has the full backing of the coalition government - was the rationalisation of three loss-making state-owned banks under a single supervisory board. Mr Derviş announced that Ziraat, Halk and Emlak banks -the three main state-owned banks - would be restructured to operate "on the basis of market rules and profitability". This would include the merger of Emlak with Ziraat, branch closures and staff cuts. The government would issue " marketable domestic debt instruments " to the equivalent of $16bn to help cover losses of more than $20bn accumulated by the three banks. The restructuring will be overseen by a common board of directors staffed by independent bankers. Other measures included legislation to make the central bank fully independent and aid liquidation of insolvent banks. There were also moves to sell off 51 per cent of Turk Telecom and accelerate privatisation of Turkish Airlines, as well as the alcohol, tobacco and sugar monopolies. Ankara also filled the important posts of treasury chief and head of the banking watchdog by respectively appointing Engin Akcakoca and Faik Oztrak, both respected technocrats. VOCABULARY: abandon a pegged exchange rate – отказаться от привязки национальной валюты к доллару inflation target – целевой ориентир уровня инфляции marketable domestic debt instruments – легкореализуемые внутренние долговые инструменты banking watchdog (supervisory board) – банковский наблюдательный совет

VOCABULARY CHECK 1) Компания, неспособная платить по своим долговым обязательствам, является неплатежеспособной. 2) В Великобритании неплатежеспособность отдельных индивидуумов может привести к банкротству, а в случае несостоятельности компаний - к ликвидации. 3) Когда компания испытывает финансовые трудности, для выправления дел судом может быть назначен администратор или конкурсный управляющий. 4) Если невозможно сохранить компанию как функционирующее предприятие, администратор продаст собственность компании, чтобы хотя бы частично выполнить обязательства перед основными кредиторами. 5) Компании, которые испытывают финансовые проблемы, часто называют «хромыми утками». 6) Антикризисные управляющие помогают компании выйти из кризиса. Если им это удается, то речь идет о серьёзном благоприятном повороте положения компании.

CASE STUDY: Europe's Enron The Ahold financial scandal should shock Europe into accounting and corporate governance reform, just as the Enron scandal did in the USA. "It may seem an exaggeration to describe the scandal overwhelming Royal Ahold as "Europe's Enron" - but in many ways it is true enough. Certainly, the world's third-biggest food retailer, after Wal-Mart and Carrefour, presents none of the financial risks ofEnron, which was both deeply in debt and the world's largest electricity giant. That apart, the similarities between the former Texan powerhouse and the Dutch retailer are striking, from the very bad corporate governance, aggressive earnings management and accounting "irregularities" to auditors whose role must be called into question. Now, at least, Europeans should stop believing that corporate wrong-doing is a US problem that cannot occur in the old continent. Instead, they should fix their own corporate governance and accounting problems. On 24 February 2003 Ahold announced the resignation of its chief executive and finance director after finding that it had overstated its profits by more than 463m ($500m). Its market value plunged by 63 per cent that day, to 33bn. In late 2001, it exceeded 30bn. Ahold is now under investigation by various authorities, including the Securities and Exchange Commission (SEC) in the USA Rather like Kenneth Lay at Enron, and Dennis Kozlowski at Tyco, another scandal-hit US firm, Ahold's now-departing boss, Cees van der Hoeven, won a huge reputation from turning a dull company into a growth machine. Investors applauded long after they should have started asking hard questions. When eventually they did ask them, his anger and pride became quickly apparent and he refused to answer. The 463m overstatement is due primarily to Ahold's US Foodservice unit, which supplies food to schools, hospitals and restaurants, although there are also issues over its Disco subsidiary in Argentina and several other units. This has led some observers to say that this is less a European problem than yet another US accounting failure. Such a claim absolves Ahold's bosses of responsibility for their acquisitions and dishonesty and ignores the persistent, firm-wide tendency to test the limits of acceptable accounting. Most firms that buy in bulk - including such admired retailers as Wal-Mart and Tesco - get discounts from suppliers if they meet sales targets. The issue is how those rebates are accounted for. The accepted practice is to wait until the targets are met. Failing firms, such as now-bankrupt Kmart, food distributor Fleming, and now Ahold appear to have booked these rebate payments before they were earned. What of Ahold's auditor? Although the problems were uncovered, it should have done so much earlier, says Lynn Turner, a former chief accountant at the SEC. VOCABULARY: bad corporate governance – неэффективное корпоративное управление Securities and Exchange Commission (SEC) - Комиссия по ценным бумагам и биржам

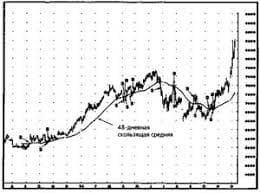

What particular skills do you think accountants need? 2. Some people consider that an accountant`s life is extremely dull and not challenging intellectually. To what extent do you agree with the judgement? Bookkeeping is really a common sense way of keeping track of the income and expenses”. What is meant by “common sense” in relation to recording income?   ЧТО И КАК ПИСАЛИ О МОДЕ В ЖУРНАЛАХ НАЧАЛА XX ВЕКА Первый номер журнала «Аполлон» за 1909 г. начинался, по сути, с программного заявления редакции журнала...  Что вызывает тренды на фондовых и товарных рынках Объяснение теории грузового поезда Первые 17 лет моих рыночных исследований сводились к попыткам вычислить, когда этот...  Что способствует осуществлению желаний? Стопроцентная, непоколебимая уверенность в своем...  Конфликты в семейной жизни. Как это изменить? Редкий брак и взаимоотношения существуют без конфликтов и напряженности. Через это проходят все... Не нашли то, что искали? Воспользуйтесь поиском гугл на сайте:

|