|

|

Taxes and their essence. The principles of taxation. Kinds of taxes. Laffer curve. The fiscal policy of the state. The tax system of Kazakhstan.Fiscal policy assumes changes in government spending G and tax collections T for the purpose of achieving a full-employment and noninflationary national output. The essence of fiscal policy is reduced to that the state, applying measures on decrease in amplitude of cyclic fluctuations, achieves higher rates of economic growth. In communication, with what the fiscal policy can be stimulating and constraining.

When recession exists, an expansionary fiscal policy is in order. If the budget is balanced at the outset, discretionary fiscal expansion should move in the direction of a government budget deficit during a recession or depression. Conversely, when demand-pull inflation stalks the land, a restrictive or contractionary fiscal policy is appropriate. Contractionary fiscal policy should move toward a surplus in the government's budget when the economy is faced with the problem of controlling inflation. To some degree appropriate changes in the relative levels of government expenditures and taxes occur automatically. This so-called automatic or built-in stability is a base of non-discretionary fiscal policy. Principles of construction of the tax system it is been: principle of community (scope of economic subjects, recipient profits taxes), principle of stability (guarantee that statutory about a budget profits will be got in full), principle of obligatory ness (forced of taxes, inevitability of their payment), social justice (establishment of taxes which put approximately in equal position of economic subjects). The tax system is an aggregate of government, regional and local dues, principles, forms and methods of their establishment and collection, change and abolition, payment and application of measures on providing of their payment, realizations of tax control, and also bringing in to responsibility and establishment of measures of responsibility for violation of tax legislation. Table 14.1 State budget РК for the period 2005-2011yy.

3. Monetary system and monetary policy of the Republic of Kazakhstan. We begin our analysis of money demand with a simple theory, known as the quantity theory, which assumes that the demand for money is proportional to income (or quantity of transactions). This link is expressed by the quantity equation: MV = PY, where M - is a quantity of money; V - is a velocity of money (the rate at which money circulates in the economy or the number of times a dollar bill changes hands in a given period of time); Y - amount of output; P - is the price of one unit of output. The change in the quantity of money (M) must cause a proportionate change in nominal GNP (PY). That is, the quantity of money determines the nominal value of output PY. If changes in the money stock lead only to changes in the price level, with no real variables (real output) changing, we say about neutrality of money. The money demand depends upon the nominal rate of interest. The link between the nominal interest rate, real interest rate and inflation rate is known as Fisher equation: i = r + π e, where r - real interest rate, π e - expected inflation. The Fisher effect says that the nominal interest rate moves one-for-one with expected inflation. Monetary system consists of monetary (making money) and non-monetary financial institutions. Monetary financial institutions constitute the banking system of country. Typical banking system is represented by institutions of two levels: monetary authorities (normally country central bank) and commercial (deposit) banks - banking financial intermediators. Central bank issues national currency, holds country reserves in gold and foreign currency, reserves funds and monitors commercial banks activities, carries out monetary policy. Central bank functions as an interbanking clearing center and as a Central Government bank. If some of these functions are performed by other governmental bodies (e.g. by Treasury), their accounts are considered to be central bank ones. Central bank acts as a lender of the last resort in reference to commercial banks. Commercial banks perform two basic functions: reception of deposits and allocation of credits. By means of these operations commercial banks create money, which distinguishes them from nonmonetary financial institutions (except monetary authorities), that is institutions having substantial liabilities in the form of deposits. The latter can be used for conducting payments in the form of cheques or in any other one.

Lecture 14.

World economy represents an aggregate of national economies developed historically and connected by the international division of labour system (IDL) and varied economic, organizational, political and other relations. World economy as a single whole developed in XX c. It had been prepared by the whole previous economy development, the formation of market relations and world market, the changeover to capitalist production, the reinforcement of a role of export the capital and international currency relations, the appearance of the colonial countries exploited by the large capitalist states. The territorial division of the world was completed, the economic division of the world took place between developed international monopolies, and the processes of the production internationalization went on. The modern world economic system is characterized by a number of the important features. First of all, it internationalization of economic life connected to the international division of labour, deepening of specialization and cooperation of production, increase of its efficiency. Two basic tendencies of internationalization of economic life appear. First, the integrity of a world economy amplifies as a result of expansion and deepening of a division of labour between the countries, liberalization of trade and other foreign economic relations, development of modern means of the information and communications. In this process TNC plays the major role. Their essence is in association national economies not by a geographical attribute (mutual borders), but on the basis of deep reproduction communications. Secondly, there is a formation concerning the independent centers of a world economy during economic interaction of the countries at a regional level and formation of large integrated structures. In the international specialization as a basis of the international economic relations the principles of absolute and comparative advantages are used. A. Smith in his work «Research about the nature and reasons of riches of the nations " has shown that the distinctions in nature and climatic conditions of the countries provide them with absolute advantages at production of the separate goods and services. Using absolute advantages in specialization of production, the countries exchange superfluous production and receive the bigger benefit in comparison with the production which is made by them. However majority of the countries has no absolute advantages, but participates in international trade, which is gainful for all the countries. D. Ricardo proved this rule by opening the law of comparative advantage. Its essence is that for each country is more expedient to specialize on those goods, production of which will be more gainful at an existing correlation of distribution cost in comparison with the production of other goods. The principle of comparative advantages says, that joint volume of edition production will be biggest when each goods will be made by that country, in which the alternative distribution costs will be lower. The difference in costs on the same goods in the different countries is caused by distinctions in levels of development of productive forces, in methods of production, its scales. All these factors influence efficiency on specialization of the countries. The modern economic science considers the theory of comparative advantages as a basis of the international economic relations and of international specialization. For example, the surplus of a labour in the country does gainful production and export of goods demanding significant expenses of work, as the cheap labour reduces costs of production of the given goods. It is more gainful for the countries having surplus of the capital to specialize on manufacture of capital-intensive production and to import labour-consuming one. The specialization is based on a principle of comparative advantages, promotes effective exploitation of economic resources of the country, growth of a level and quality of life of the population.

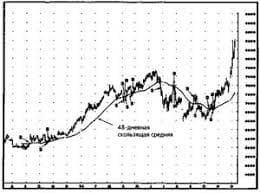

Что вызывает тренды на фондовых и товарных рынках Объяснение теории грузового поезда Первые 17 лет моих рыночных исследований сводились к попыткам вычислить, когда этот...  Конфликты в семейной жизни. Как это изменить? Редкий брак и взаимоотношения существуют без конфликтов и напряженности. Через это проходят все...  Что делать, если нет взаимности? А теперь спустимся с небес на землю. Приземлились? Продолжаем разговор...  ЧТО И КАК ПИСАЛИ О МОДЕ В ЖУРНАЛАХ НАЧАЛА XX ВЕКА Первый номер журнала «Аполлон» за 1909 г. начинался, по сути, с программного заявления редакции журнала... Не нашли то, что искали? Воспользуйтесь поиском гугл на сайте:

|